2025 TSE Growth Market Reform Explained | New Listing Standards & 3 Strategic Options

Sep 28, 2025

Last Updated: September 29, 2025

The Challenge Facing CEOs

“Will our company maintain its listing status?”

In 2025, the Tokyo Stock Exchange announced a fundamental reform. Furthermore, the new standards are significantly stricter.

What You’ll Learn

The new listing standards require ¥10 billion market cap. Consequently, many executives are struggling to respond. However, there are multiple strategic options available.

This article explains three pathways. Firstly, continuing growth on the Growth Market. Secondly, utilizing the grace period. Thirdly, transitioning to the Standard Market. Therefore, you can find the optimal strategy.

Background: Moving Beyond “IPO as the Goal”

The Core Problem

Why is reform necessary now?

The answer is straightforward. Many companies treat listing as the goal. Moreover, post-IPO growth initiatives are lacking.

TSE’s Assessment

According to the TSE’s 2025 proposal, structural issues exist. The market should foster high growth. However, reality differs significantly.

Some firms lack strategic investor engagement. Additionally, sustained growth initiatives are insufficient. Therefore, reform became necessary.

The Previous Standard

The old requirement was too lenient. Companies needed only ¥4 billion after 10 years. Consequently, low growth was acceptable.

The Resulting Gap

As a result, market turnover stagnated. Furthermore, the gap with investor expectations widened. Therefore, comprehensive reform was required.

New Standard: ¥10 Billion Market Cap

The Bottom Line

After 5 years from IPO, ¥10 billion market cap is required.

This represents a substantial increase. Previously, ¥4 billion was sufficient. Moreover, the timeline shortened from 10 years to 5 years. Therefore, the standard is significantly stricter.

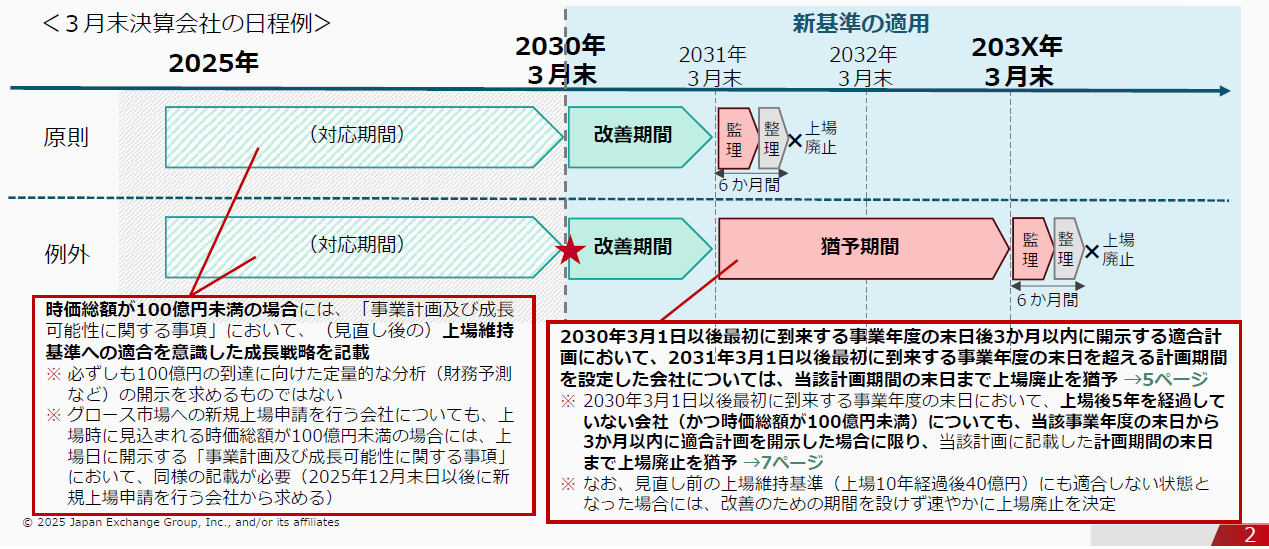

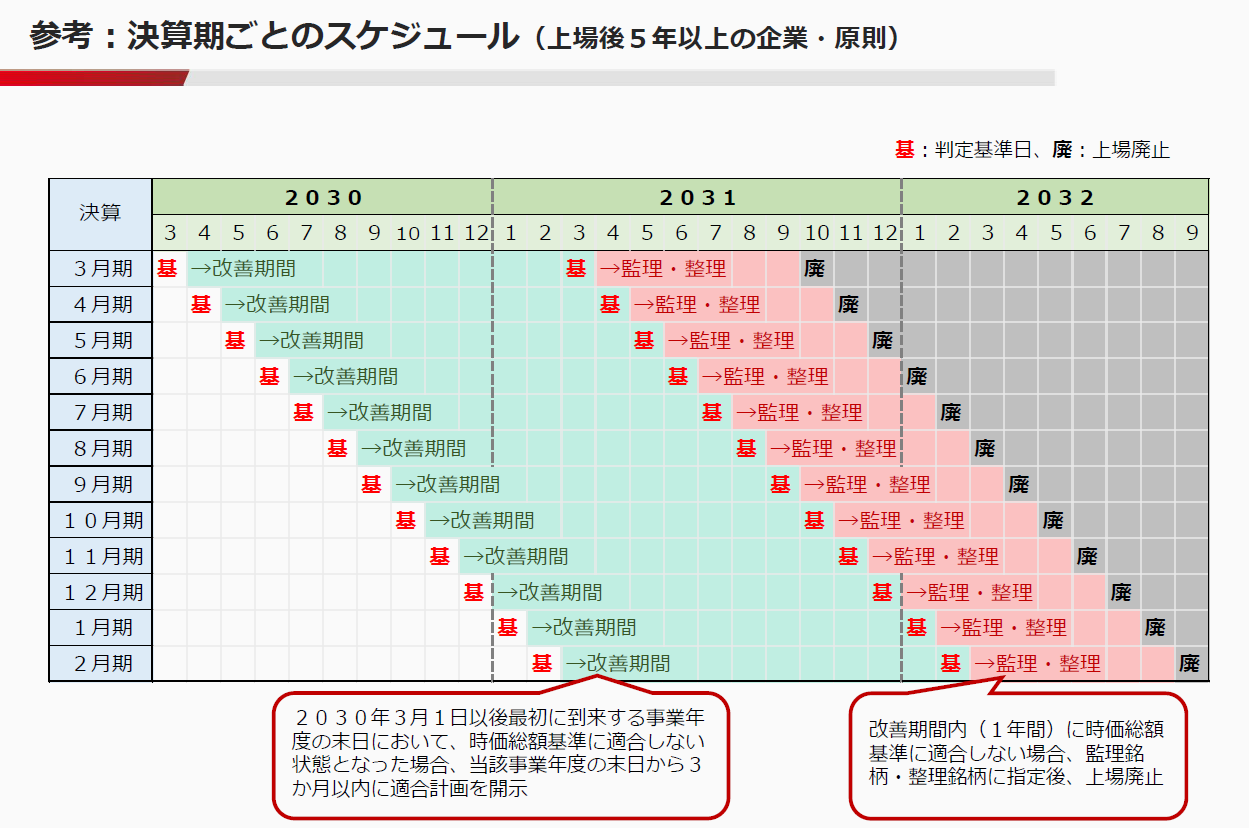

Implementation Timeline

The standard applies from March 1, 2030. Specifically, it starts at fiscal year-end. Companies failing to meet it enter improvement period. Subsequently, if still unmet, delisting occurs.

Key Requirements

- Effective Date: Fiscal year-end after March 1, 2030

- New Standard: ¥10 billion after 5 years

- Improvement Period: One year to comply

- Exception: Plans allow extended listing

The Exception Mechanism

Importantly, adaptation plans provide relief. The plan period has no fixed limit. However, longer plans face investor skepticism. Therefore, realistic timelines are crucial.

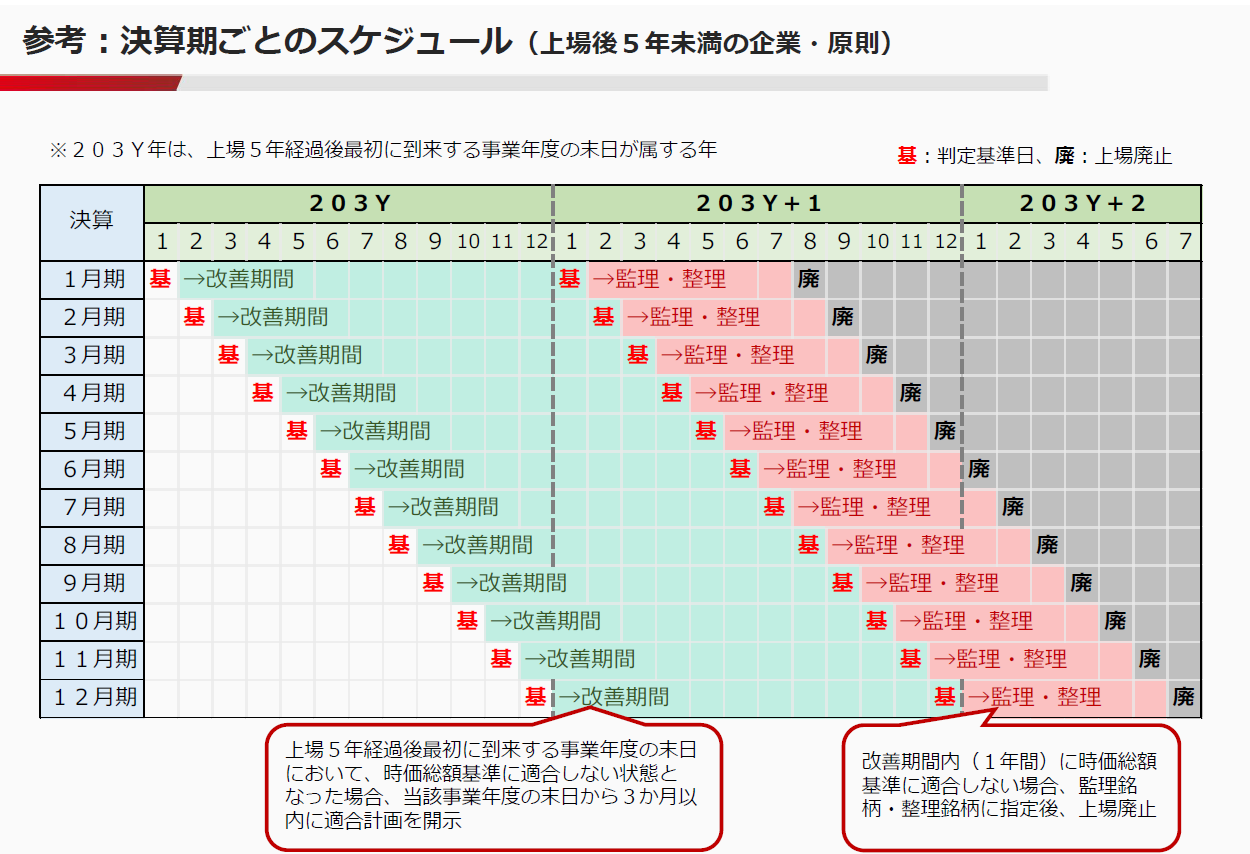

Phased Implementation Schedule

Two Application Patterns

When will the standard apply?

The timing depends on listing date. Therefore, companies fall into two categories. Each category has distinct timelines.

①Companies Listed 5+ Years

If below threshold at fiscal year-end 2030, improvement begins. Consequently, immediate action is needed. Furthermore, the clock starts ticking quickly.

②Companies Listed Under 5 Years

The requirement applies at the 5-year mark. If unmet then, improvement period begins. Therefore, planning time is available.

Corporate Options: Three Pathways

Strategic Choices

How should companies respond?

Three main options exist. Moreover, each suits different situations. Therefore, careful evaluation is essential.

①Growth Market Continuation

This is the orthodox path. You achieve ¥10 billion market cap. Additionally, you maintain Growth Market listing. However, sustained high growth is required.

②Grace Period Utilization

Alternatively, use the grace period system. This provides restructuring time. Furthermore, it allows strategic repositioning. Consequently, companies get breathing room.

③Standard Market Transition

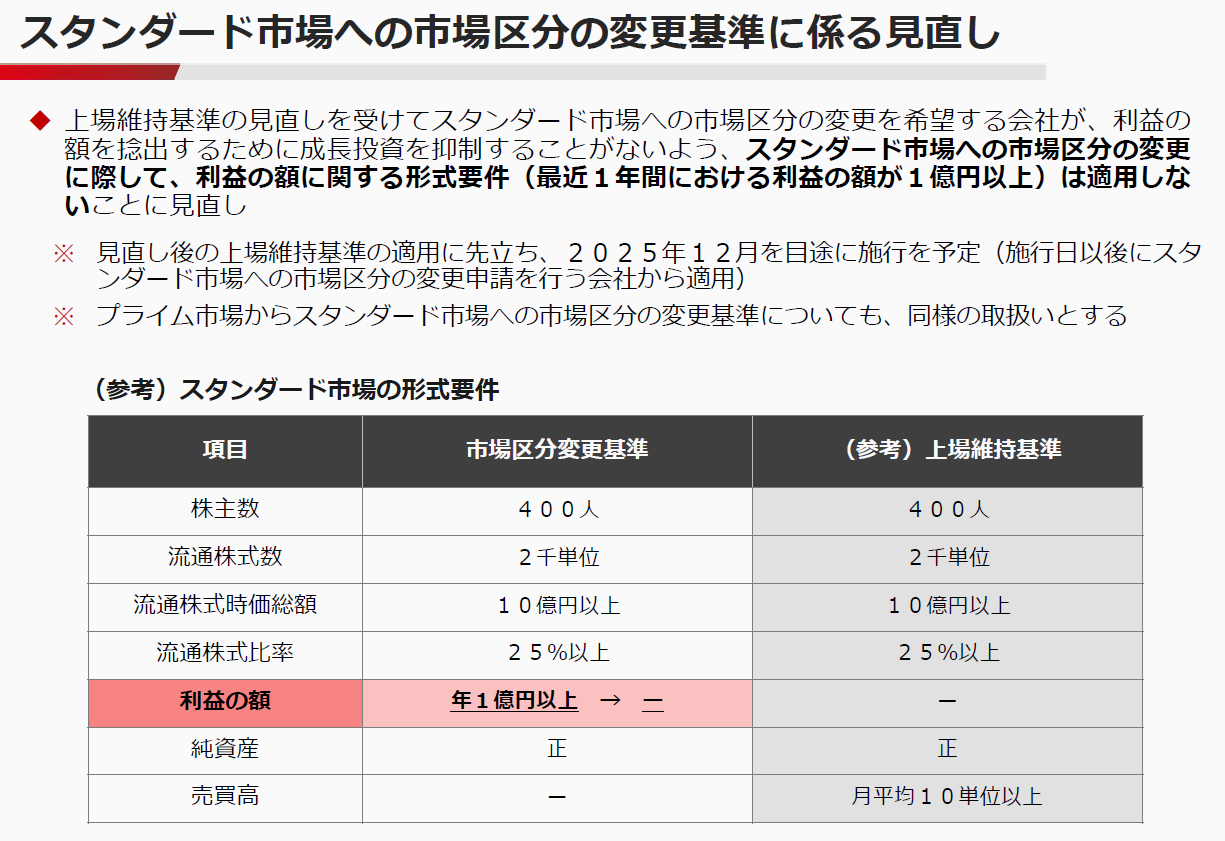

This is now the most realistic option. Additionally, profit requirements were abolished. Consequently, transition became much easier. Therefore, many companies consider this path.

Standard Market Transition

The Game-Changing Revision

The ¥100 million annual profit requirement is abolished.

This is the most significant change. Previously, consistent profitability was mandatory. However, this curtailed growth investments. Therefore, the TSE revised the rule.

Why the Change?

The rationale is clear. Growth companies need investment freedom. Moreover, short-term profits shouldn’t constrain strategy. Therefore, the system now encourages aggressive investment.

New Requirements (December 2025)

| Item | Criteria | Purpose |

|---|---|---|

| Shareholders | 400+ | Ensures liquidity |

| Tradable shares cap | ≥ ¥1B | Indicates scale |

| Tradable ratio | ≥ 25% | Broad participation |

| Tradable units | ≥ 2,000 | Guarantees liquidity |

| Net assets | Positive | Financial soundness |

| Profit | Abolished | ¥100M rule removed |

Who Should Consider Transition?

Which companies benefit most?

Several types qualify now. Moreover, each has unique advantages. Therefore, evaluation is worthwhile.

Eligible Company Examples

- Companies with aggressive growth investment

- Companies with heavy R&D spending

- Companies conducting large M&A

Strategic Benefits

- Freedom from ¥10 billion threshold

- Continued growth investments

- Access to stable investor base

Therefore, transition offers a viable growth path.

Grace Period Relief System

The Safety Net

Plans allow listing maintenance during adaptation period.

The grace period provides crucial relief. However, specific conditions apply. Moreover, risks remain present. Therefore, careful planning is essential.

How It Works

The process has three steps. First, if below ¥10 billion, improvement begins. Second, disclose an adaptation plan. Third, meet standard by plan end. Consequently, listing is maintained.

Duration Considerations

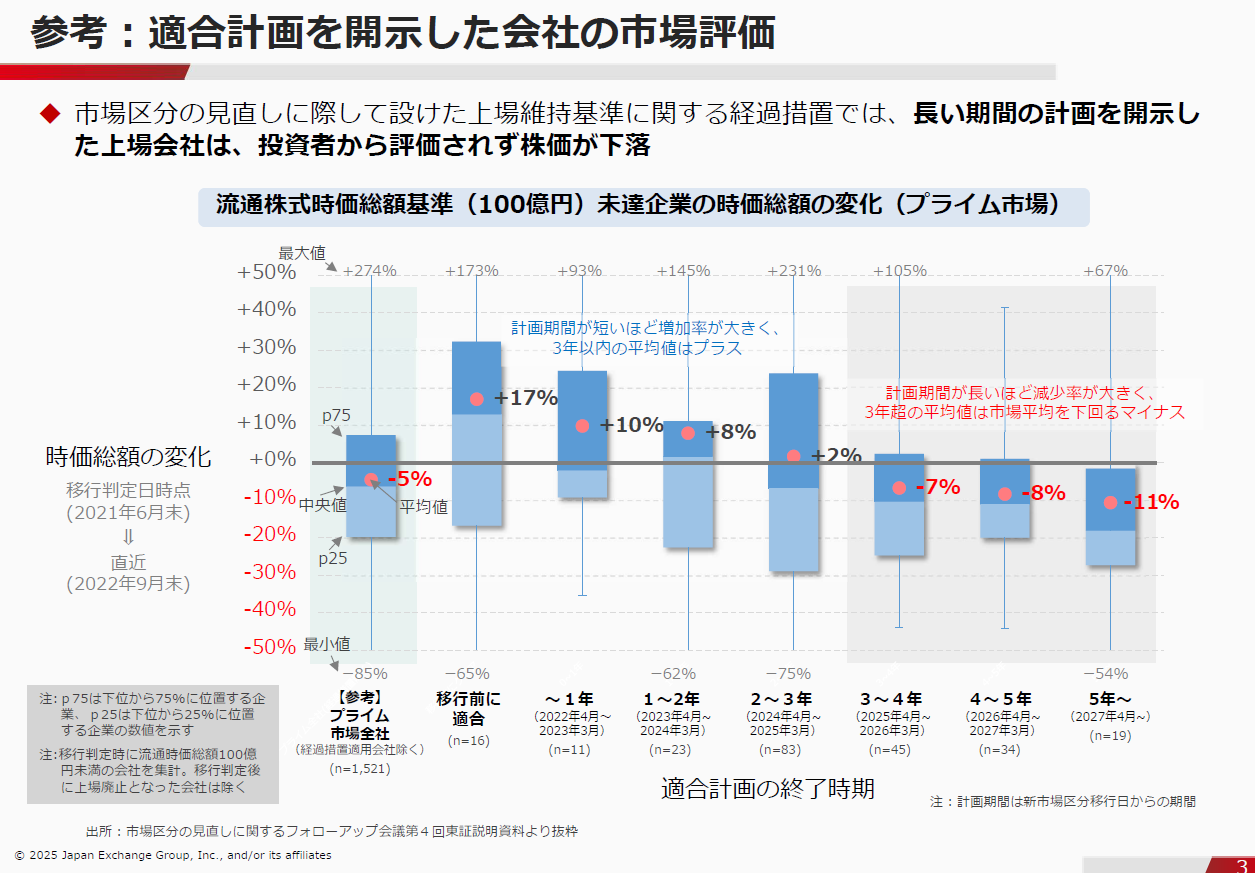

Importantly, no maximum duration exists. However, data reveals a trend. Longer plans underperform significantly. Therefore, realistic timelines matter greatly.

Critical Warning

⚠️ Delisting Risk Remains

Even during grace period, risks exist. Specifically, the old ¥4 billion standard still applies. If you fall below it, delisting occurs. Therefore, dual compliance is necessary.

Plan Duration Strategy

Setting duration correctly is crucial. Overly long plans signal low feasibility. Consequently, stock prices may decline. Therefore, balance ambition with realism.

Seven Executive Misconceptions

The Paradigm Shift

What misconceptions limit growth company success?

Seven common beliefs hinder performance. Moreover, the TSE expects fundamental change. Therefore, mindset reform is essential.

①Growth Rate Expectations

Aim for 20–30% annual growth.

“Steady growth” is insufficient. Furthermore, investors expect aggressive expansion. Therefore, incremental improvements fall short. Consequently, ambitious targets are necessary.

②Capital Raising Strategy

Capital increases are welcome with strong equity stories.

Don’t fear dilution excessively. Instead, focus on growth opportunity. Moreover, well-justified fundraising receives support. Therefore, communicate vision clearly.

③Shareholder Return Philosophy

Prioritize growth investment over dividends.

Investors seek price appreciation, not dividends. Moreover, dividends divert capital. Therefore, reinvestment is preferred. Consequently, focus on growth.

④Profitability Timing

Short-term losses are acceptable for future investment.

Amazon exemplifies this approach. The company operated unprofitably for years. However, investors supported the vision. Consequently, patient capital enabled growth. Therefore, focus on long-term value.

⑤Growth Strategy Mix

Use inorganic growth proactively.

Don’t rely solely on organic growth. Additionally, M&A accelerates market entry. Moreover, strategic acquisitions add capabilities. Therefore, consider all options.

⑥IR Audience Sequencing

Win retail support first, then approach institutions.

The sequence matters significantly. Retail investors provide initial momentum. Subsequently, institutional interest follows. Therefore, build support systematically. Consequently, traction accelerates.

⑦Forecast Management

Honest explanation beats avoiding downward revision.

Concealment destroys trust permanently. Instead, explain transparently. Moreover, outline corrective actions. Consequently, investors appreciate honesty. Therefore, prioritize communication.

Market Impact and Outlook

The Big Picture

What market changes will result?

“Selection and concentration” will accelerate. Furthermore, market clarity improves. Therefore, investors benefit significantly.

Clear Differentiation

Companies now choose optimal markets. This depends on growth stage. Moreover, strategy determines fit. Therefore, the TSE’s vision clarifies.

High-growth pursuers concentrate in Growth Market. Meanwhile, stability-focused companies thrive in Standard Market. Consequently, distinct characteristics emerge. Therefore, positioning becomes clearer.

Expected Outcomes

Several changes are anticipated. First, market turnover advances. Second, comprehension improves. Third, capital allocation becomes efficient. Therefore, overall market quality rises.

💡 Key Takeaways

- New ¥10 billion standard applies from 2030

- Three options available to companies

- Standard Market profit requirement abolished

- Executive mindset transformation essential

References

- Tokyo Stock Exchange “Review of Growth Market Listing Maintenance Standards”

https://www.jpx.co.jp/news/1020/20250926-01.html

You are welcome to contact us via the Contact Form to discuss and for more information.

Common Management Mindset Gaps