Why Engage in a Merger or Acquisition?

Dec 06, 2021

2021 is shaping up to be a record year for the total value of mergers and acquisitions completed around the world. While the post-pandemic economic rebound certainly has a large part to play in that, the fundamental reasons why M&A remain popular for businesses today is a topic we’d like to address in this post.

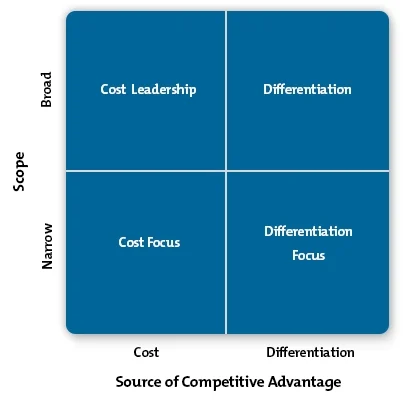

A business contemplating a merger or acquisition will consider a multitude of factors based on their particular situation and the state of the market. These factors will be analyzed according to the particular strategy that the business is pursuing. It’s important to note that an M&A strategy will always fit into a pre-existing business strategy. According to Michael Porter of Harvard University, there are three fundamental strategies which a business may choose to pursue to gain a competitive advantage:

Cost leadership (offering the lowest cost for a product or service)

Differentiation (offering products or services which are uniquely different from others)

Focus (offering a particular service in a niche market OR an advantageous cost in such a market)

The following table gives us a visual summary of these strategies:

Image From Mindtools.com

M&A Strategies

Based on these more general strategies, a business may choose to pursue different kinds of specific M&A strategies. In her book, The Art of M&A: A Merger, Acquisition, and Buyout Guide, Alexandra Reed Lajoux sets out four main types of M&A strategy:

- Portfolio-building

- Cost-cutting

- Revenue-growth

- Strategic Options1

Let’s look at these together.

1. Portfolio-building

Mrs. Laroux defines a portfolio company as “an entreprise composed of multiple independent companies obtained through acquisition”2. A good example of this would be Johnson & Johnson, which sells over-the-counter drugs but also owns a sports performance research institute and is heavily invested in the medical device industry. A company like J&J performs well, in part, because it has diversified its portfolio. By acquiring a pre-existing company, a portfolio company can buy itself into a new sector or industry or it can widen the range of products and services it offers in the same market.

2. Cost-cutting

When the acquired company is merged with the acquirer, some companies are able to cut costs by the effect of cost synergy. In principle, the cost of running two separate companies will be higher than the cost of running those two companies as a single merged entity. For example, the resulting merged entity will not require two separate CEOs, and so it may be expected that overall salary costs will be reduced. In the same way, the two merging entities may share a single factory or the same office business, which will also reduce the overall costs of running the new entity.

3. Revenue-growth

By acquiring a new company, the acquirer will the revenue streams of this new asset. The acquirer can effectively buys themselves new customers. Other revenues could include the revenue obtained from intellectual property or the complimentary effect of combining the acquirer’s current products with the products of their new acquisition.

4. Strategic Options

Sometimes a company will acquire another company not for the immediate benefits listed in points #1 to #3, but for long-term benefits. Mrs. Lajoux defines these as “real options”, which derive their value from real capital assets3. The idea is to purchase a company today which can add value to a future strategy. For example, such a strategy may involve a car company acquiring a firm specializing in laser navigation in the hopes of one day selling self-driving cars. In this case, the car company does not hope to gain revenue from the specialized firm immediately, but hopes to integrate their technology on a future line of cars.

Reasons for M&A

In keeping with these main M&A strategies, there can a multitude of other reasons which may motivate a company to engage in M&A. Mrs. Lajoux’s Art of M&A proves itself once again useful by providing a list of the 10 most common reasons why companies make acquisitions4:

- Achieve economies of scale by buying a customer, supplier, or competitor (operating synergy)

- Accomplish strategic goals more quickly and more successfully (strategic planning)

- Realize a return on investment by buying a company with less efficient managers and making them more efficient (differential efficiency)

- Realize a return by buying a company with inefficient managers and replacing them (inefficient management)

- Increase market share (market power)

- Lower cost of capital by smoothing cash flow and increasing debt capacity (financial synergy)

- Take advantage of a price that is low in comparison to past stock prices and/or estimated future prices, or in relation to the cost the buyer would incur if it built the company from scratch (undervaluation)

- Assert control at the board of directors level in an underperforming company with dispersed ownership (agency problems)

- Obtain a more favorable tax status (tax efficiency)

- Increase the revenues or size of a company and therefore increase the pay and/or power of managers (managerialism – never a stated goal, but an explanation offered in many academic studies)

Final Thought

As we mentioned in the beginning of this article, the decision to pursue an M&A strategy will always be preceded by a larger business strategy. Within this strategy, many different options may appear as viable options for helping one’s company grow. As the market is ever-changing, new opportunities will constantly appear. Hopefully, this article will help you to make more sense of the options available to you and your company.

Footnotes

1. Alexandra Reed Lajoux, The Art of M&A: A Merger, Acquisition, and Buyout Guide, Fifth Edition, page 35.

2. Id.

3. Id., page 38.

4. Id., page 19.

You are welcome to contact us via the Contact Form to discuss and for more information.